.png)

How AI Transforming Payroll Management in 2026: A Strategic C-Suite Perspective

.png)

Payroll has always been one of the most business-critical yet operationally complex functions in any organization. It directly affects employee trust, financial accuracy, statutory compliance, and brand credibility. A single payroll error can lead to dissatisfaction, regulatory penalties, and reputational damage.

As organizations enter a highly digitized, globally distributed, and regulation-heavy era, traditional payroll systems are no longer sufficient. This is precisely how AI transforming payroll management in 2026 becomes a defining shift — not as a technological upgrade, but as a strategic business transformation.

For CEOs, CFOs, CHROs, and founders, payroll in 2026 is no longer about processing salaries. It is about intelligence, foresight, risk management, and workforce confidence.

Why Payroll Transformation Became Inevitable

For decades, payroll relied on rule-based engines, manual checks, and retrospective audits. While this approach worked in relatively stable environments, today’s workforce realities have changed dramatically.

Organizations now manage:

- Multi-state and multi-country payroll structures

- Hybrid, remote, contract, and gig workers

- Complex tax regimes and frequently changing labor laws

- Variable pay, incentives, ESOPs, and flexible benefits

Manual payroll operations and static automation tools struggle under this complexity. Errors increase, compliance risks multiply, and payroll teams spend more time fixing issues than preventing them.

This is where AI transforming payroll management in 2026 addresses the root problem — not by adding more rules, but by introducing learning, prediction, and automation at scale.

Why Payroll Transformation Became Inevitable

For decades, payroll relied on rule-based engines, manual checks, and retrospective audits. While this approach worked in relatively stable environments, today’s workforce realities have changed dramatically.

Organizations now manage:

Multi-state and multi-country payroll structures

Hybrid, remote, contract, and gig workers

Complex tax regimes and frequently changing labor laws

Variable pay, incentives, ESOPs, and flexible benefits

Manual payroll operations and static automation tools struggle under this complexity. Errors increase, compliance risks multiply, and payroll teams spend more time fixing issues than preventing them.

This is where AI transforming payroll management in 2026 addresses the root problem not by adding more rules, but by introducing learning, prediction, and automation at scale.

What AI-Driven Payroll Really Means in 2026

AI-powered payroll is not about replacing HR or finance professionals. Instead, it enhances human decision-making by handling complexity that humans should not manually manage.

In 2026, AI-driven payroll systems are defined by their ability to:

Learn from historical payroll patterns

Detect anomalies before payroll is finalized

Predict compliance risks and cost fluctuations

Adapt automatically to regulatory changes

Provide real-time payroll intelligence to leadership

Unlike traditional payroll software, AI systems continuously improve with each payroll cycle. This self-learning capability is the foundation of how AI transforming payroll management in 2026 delivers consistent accuracy and scalability.

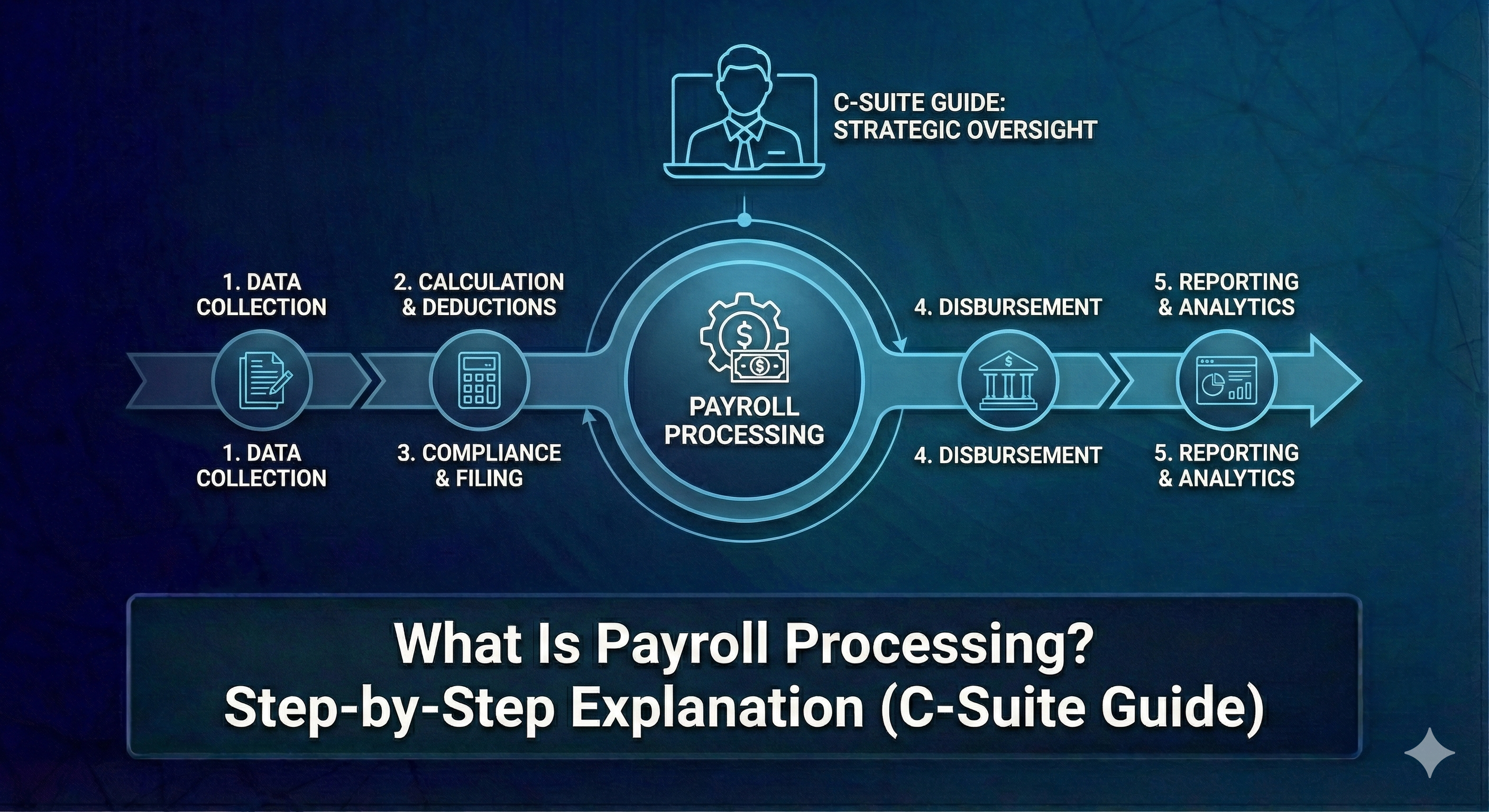

From Data Collection to Validation: Payroll Accuracy Starts Earlier

One of the most significant changes AI brings to payroll is when errors are identified.

In older systems, payroll discrepancies were discovered after salary processing leading to rework, reversals, and employee dissatisfaction. In contrast, AI systems validate payroll inputs continuously.

Attendance data, leave records, overtime hours, shift allowances, reimbursements, and variable pay are monitored in real time. AI flags inconsistencies such as unusual overtime spikes, missing attendance logs, or duplicate claims before payroll is locked.

This proactive validation approach ensures that payroll accuracy is built into the process itself one of the clearest examples of AI transforming payroll management in 2026 from reactive to preventive.

Intelligent Payroll Calculations at Enterprise Scale

Payroll calculations in 2026 are no longer static formulas. AI-powered engines dynamically apply salary rules based on multiple variables, including location, role, tenure, benefits eligibility, and regulatory requirements.

Machine learning models analyze past payroll runs to identify patterns and optimize calculations. Over time, the system becomes more precise, reducing the need for manual corrections and overrides.

For large organizations operating across regions, this intelligence enables payroll scalability without proportional increases in payroll headcount making AI transforming payroll management in 2026 a direct contributor to operational efficiency.

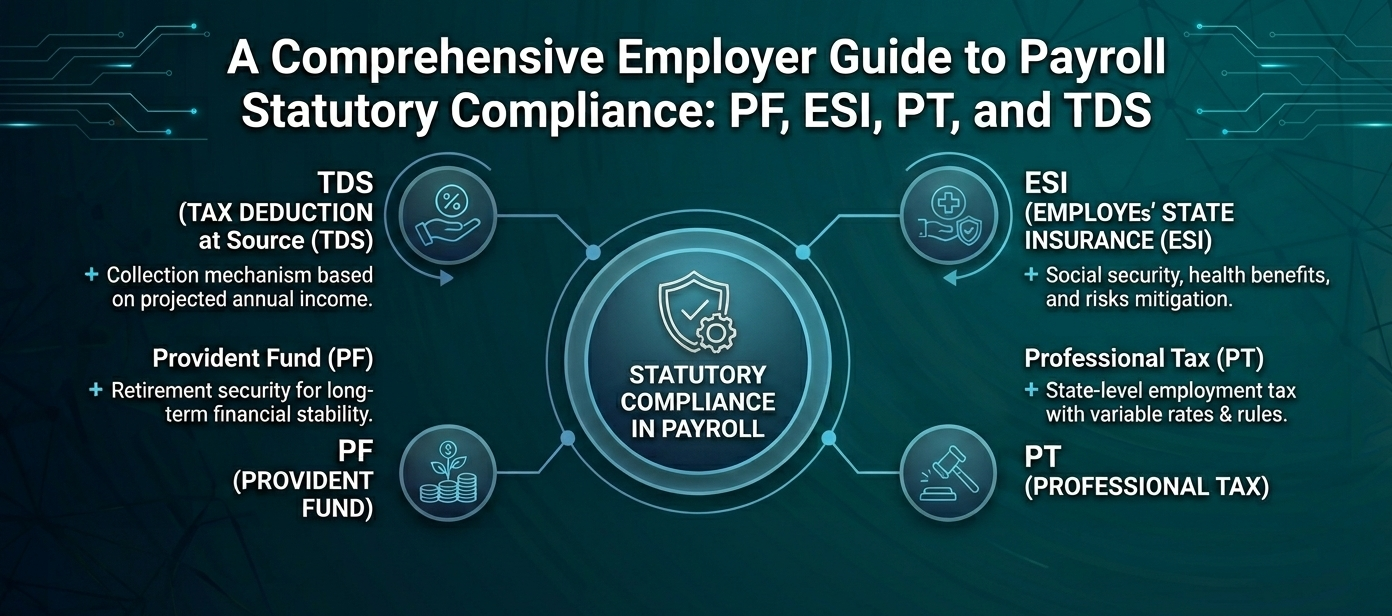

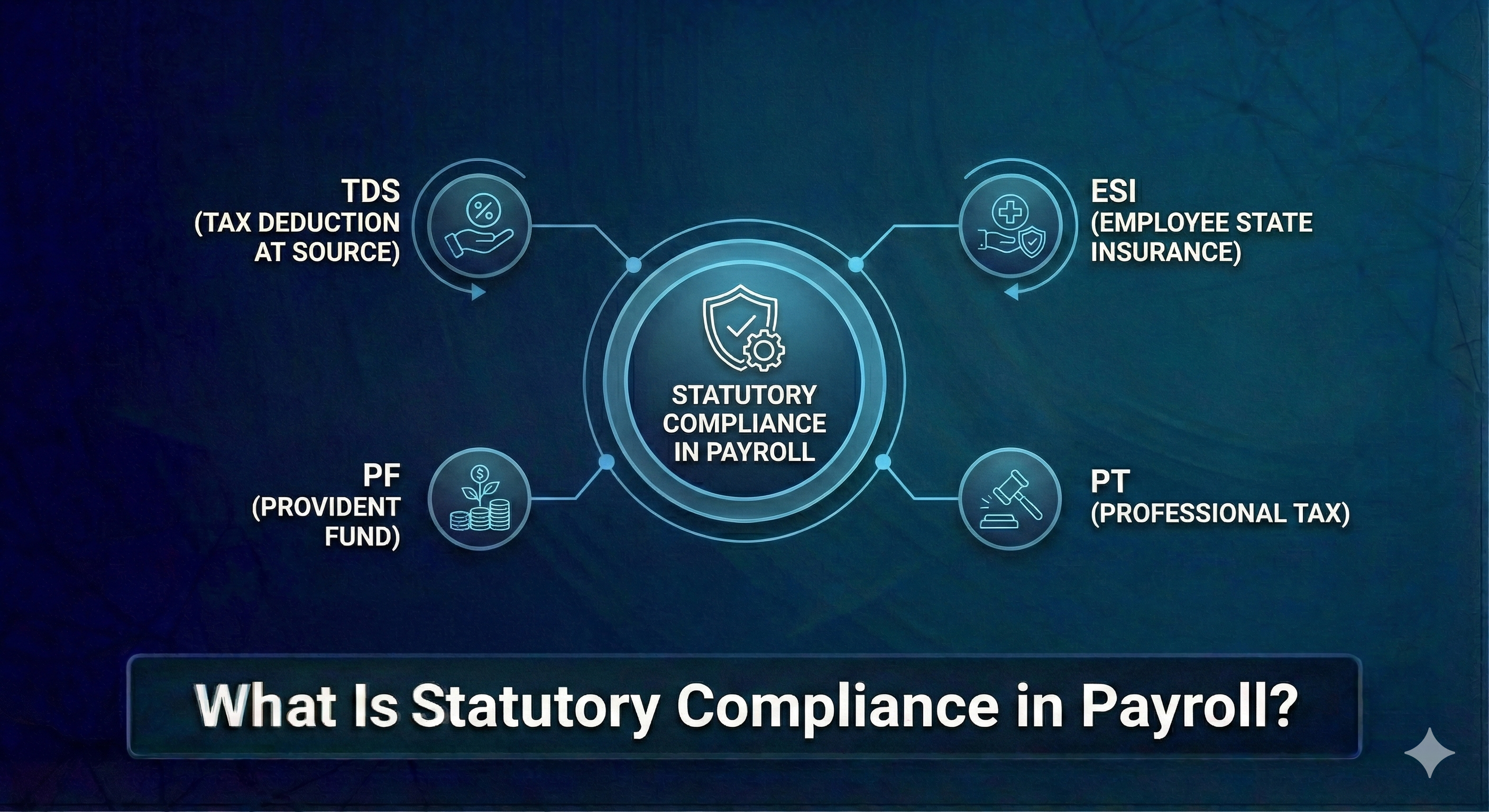

Compliance Moves from Reactive to Autonomous

Compliance has historically been one of payroll’s biggest risks. Laws change frequently, interpretations vary, and manual updates often lead to delays or misapplication.

In 2026, AI-powered payroll systems continuously track statutory changes, tax updates, and labor regulations across jurisdictions. These updates are automatically reflected in payroll rules, calculations, and reports.

More importantly, AI maintains audit-ready compliance logs and proactively flags potential violations before payroll processing begins. For leadership teams, this means reduced legal exposure, lower compliance costs, and stronger governance.

This autonomous compliance capability is one of the strongest business cases for AI transforming payroll management in 2026.

Predictive Payroll Risk Management

A defining advantage of AI payroll systems is their ability to predict issues before they occur.

By analyzing historical payroll data, AI models identify employees, departments, or scenarios with a higher probability of discrepancies. This includes duplicate payments, incorrect deductions, ghost employees, or unusual reimbursement behavior.

Instead of investigating after an issue arises, payroll teams receive early warnings and actionable insights. This shift from correction to prevention fundamentally changes payroll risk management and highlights how AI transforming payroll management in 2026 protects both finances and trust.

Redefining the Employee Payroll Experience

Payroll is one of the most personal interactions employees have with an organization. Confusion or delays directly impact morale.

In 2026, AI enhances employee experience through conversational interfaces and self-service intelligence. Employees can ask natural-language questions about their payslips, deductions, tax calculations, or incentives and receive instant, accurate explanations.

Clear visibility into earnings builds transparency, while faster resolution of payroll queries reduces frustration. As a result, payroll becomes a trust-building function rather than a complaint driver another key dimension of AI transforming payroll management in 2026.

Payroll Analytics Becomes a Strategic Intelligence Layer

Perhaps the most underestimated impact of AI payroll is analytics.

AI-driven payroll systems generate insights that go far beyond salary totals. Leadership teams gain visibility into payroll cost trends, overtime patterns, workforce expense forecasting, and the financial impact of attrition or hiring plans.

For CFOs, this enables more accurate cash-flow planning. For CHROs, it supports workforce strategy and compensation optimization. For CEOs, it offers a real-time view of workforce economics.

This transformation of payroll data into business intelligence is central to how AI transforming payroll management in 2026 elevates payroll from operations to strategy.

Payroll as Part of an Intelligent HRMS Ecosystem

In 2026, payroll cannot operate in isolation. Its effectiveness depends on seamless integration with core HR, attendance, leave, benefits, and finance systems.

AI-native HRMS platforms create a unified data environment where payroll decisions are always based on accurate, up-to-date employee information. Platforms like JioHRMS support this integration by enabling smooth data flow, compliance alignment, and analytics visibility without disrupting existing workflows.

When payroll intelligence operates within an integrated HRMS ecosystem, the value of AI transforming payroll management in 2026 multiplies significantly.

Security, Trust, and Ethical AI in Payroll

With AI handling highly sensitive compensation data, trust is non-negotiable.

Modern payroll systems in 2026 are built with enterprise-grade security, role-based access controls, encryption, and explainable AI models. Decisions made by AI are transparent and auditable, ensuring fairness and regulatory compliance.

This alignment with ethical AI principles reinforces EEAT standards and builds confidence among leadership and employees alike.

What This Means for C-Suite Leaders

For executives, AI payroll is not a technology upgrade it is a governance and growth enabler.

CFOs gain predictability and cost control.

CHROs reduce payroll grievances and strengthen employee trust.

CEOs enable scalable, compliant growth without operational drag.

This cross-functional impact explains why AI transforming payroll management in 2026 is now a boardroom-level discussion.

Why Payroll Transformation Became Inevitable

Why Payroll Transformation Became Inevitable